About Us

“In our relentless pursuit of driving ‘win-win’ outcomes for our clients, we prioritise alignment of interests and long term wealth generation in all transactions and investments that we advise on.”

– Amit Khanna

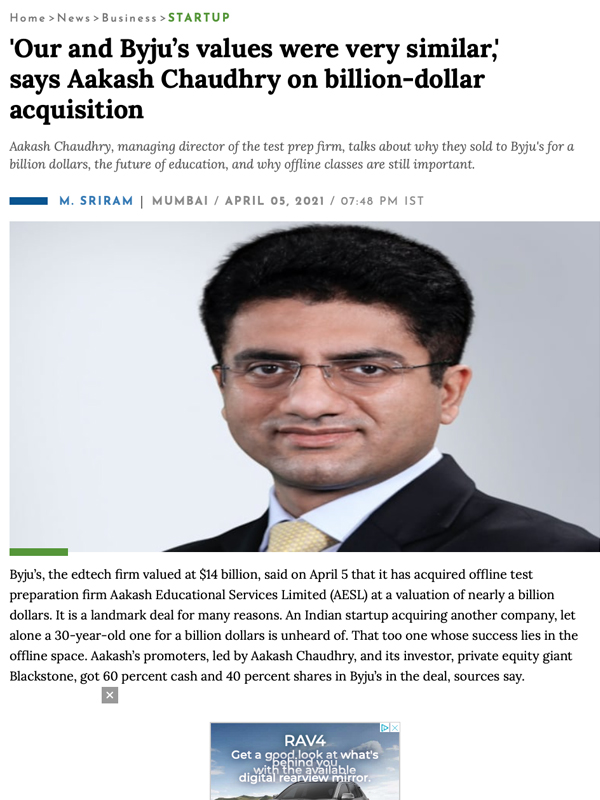

Phoenix Advisers is a Transaction advisory and Multi-Family Office firm with offices in New Delhi and Singapore. The firm is founded by professionals with decades of experience advising on complex transactions and Investment advisory & management. Having the valuable perspective of both ‘buy’ & ‘sell’ side negotiations across multiple transactions, the team at ‘Phoenix Advisers’ has served as shareholders representatives for some of the country’s largest corporates and families for transactions in the Real Estate and Education sectors. With a time tested philosophy of achieving ‘win-win propositions’, ‘Phoenix Advisers’ aims to generate long term value for its clients.

Service Offering

Transaction advisory

- Commercials strategy & valuation advisory

- Structured sell side/buy side process management

- Structuring & documentation advisory (in conjugation with tax/legal counsels)

- Comprehensive business plans (including financial modelling) assessments

- Sectoral insights and industry specific financial data analytics

- JV structuring & regulatory advisory

Multi-Family office advisory

- Multi asset wealth advisory & investment solutions services

- Market insights & research

- Banking & credit advisory services

- Financial management & wealth succession planning advisory

- Pro-active asset management & reporting

With decades of experience

Meet our team

With decades of experience

Meet our team

Agam Sarin

VP – Transactions & Investments

Shatakshi Kapoor

SR. Legal Manager

Amit Khanna

Amit is the founder-director of ‘Phoenix Advisers’. With over two decades of experience as an entrepreneur, investor, business leader and adviser, Amit has created meaningful impact across a diverse set of industries like Real Estate, Education, Financial Services, Mining and Retail. Over years, he has been advising large corporates and family offices in real estate development & investments, mergers & acquisitions, equity & debt investments, Indian Art -investments etc.

Some of his entrepreneurial ventures include ‘Cornerstone Real Estate’ (an affordable housing JV set to deliver 1300 homes at $33,000 each in Gurgaon) & GRAAVAA (India’s first retail format for Natural Stone delivering a « Quarry to Floor » integrated value chain).

In his previous role, Amit was the CEO and General Partner of InterGlobe Real Estate (real estate fund for InterGlobe Enterprises (Founders of Indigo Airlines)) where he managed an AUM of $350m over a portfolio of 1mn sft of Indian commercial real estate. Formerly, Amit also ran the ‘The Phoenix Fund’ (a SEBI registered Portfolio Management Scheme with AUM of over $ 150 m) and cofounded ‘IIFL Phoenix Cash Opportunities Fund’ (investments in Indian debt products)

As an avid investor, Amit has made investments in various private & public companies such as Hopscotch.in (online baby clothes e-commerce site), Shantha Biotech (Biotech company), Aro Granite (Listed granite processing company), Paytm, Cipher (Cancer Care), United Wind (US based distributed wind energy company) etc.

At Indian School of Business, Amit served on the Endowment Fund’s advisory council after conceptualising and seeding the school’s first Endowment Fund. He also serves on the advisory board of Udyaan Care, an NGO for abandoned & orphan children.

Amit is a Chartered Accountant by qualification and has attended Post Graduate Programme in Management (ISB, Hyderabad, Co2004) & Owners President Management Program OPM49 (Harvard Business School)

Deepika Khanna

Deepika is the Director – Legal based in our New Delhi office, specialising in M&A, Private Equity, Joint Ventures, General corporate commercial advisory across India.

She is a specialized transactions lawyer, with over 14 years of experience and has an established track record in advising clients across various sectors including real estate, education, hospitality & leisure, publishing & media, alcohol & beverage, charitable organizations, and microfinance. Previously, Deepika has represented domestic and international clients in private equity investments, mergers & acquisitions, joint ventures, exchange control regulations, outbound investments, general corporate advisory matters, corporate restructurings, corporate governance, contract law matters, securities law matters including insider trading/ takeover regulations.

In addition to providing transactional advice, Deepika also has an extensive experience in advising Indian companies on day-to-day compliance and regulatory issues including requirements for regulatory approvals/ licenses, corporate and governance affairs & drafting and review of various operational contracts.

In her prior role, Deepika was a Partner with AZB & Partners, a leading law firm in India. She has also worked with InterGlobe Enterprises, a large Indian conglomerate.

Deepika holds an LL.M degree in Corporate Law from New York University School of Law, LL.B & Bachelor’s degree in Arts from Amity Law School, Delhi.

Muskan Ahuja

Muskan holds the designation of Senior Analyst – Transactions and is based out of our New Delhi Office. She has around 4 years of experience in Corporate Advisory and Financial Management across different industries including education, tech & media.

Previously, Muskan has worked as a Corporate Finance Analyst at a boutique corporate advisory firm, Modus Partners Singapore where she was involved in evaluating sell side transactions for the company.

Muskan holds a Master’s degree in Finance & Accounting from Imperial College Business School, London & Bachelor’s degree in Commerce from College of Vocational Studies, Delhi University.

Contact us

Contact us

Get in touch at +91 97177 47538